countdown

Foreword

In 2018, cotton imports surged to 1574kt or 36.46% as soon as the cotton import quotas increased. In 2019, cotton import policies will continue to be adjusted, thus will cotton import volume increase further? How will cotton policies in China change and will the cotton price in China connect with international one?

On-call transactions of cotton futures turned more mature and active in 2018. In 2019, cotton options will be listed. What is the impact on cotton market and how to participate in?

Renminbi depreciated largely in 2018 with the largest decrement of 11.9%. Amid rising cost, imported cotton yarn traders suffered great losses. Even so, cotton yarn imports still approached 1.95 million tons or 4.3% higher than that in 2017. Where will imported cotton yarn go in 2019?

In 2018, state reserved cotton sales continued. Favored by cotton cost, cotton textile mills enjoyed good profit. However, in Mar 2019, the state reserved cotton sales did not proceed as expected. Thus, will the profit favored by cost appear again and in which way will it appear?

In 2018, trading volumes of cotton yarn futures increased and more factory warehouses participated in. In 2019, the rules of cotton yarn futures are improved further, and become more consistent with the characteristics of cotton yarn market. How much does cotton yarn futures market expand amid new rules and how should the market be operated?

In 2018, downstream consumption gained the most attention of the market. The contradiction existed between great data and bad feeling. What’s the actual appearance of downstream consumption? How will the terminal industry development trend and yarn procurement tempo change in 2019?

Besides, the capital and industry upgrading also won much attention. In 2019, the market situation and policy both change and opportunities and challenges coexist. For the hotspots abovementioned, CCFGroup will hold “2019 China Cotton Textile Forum (The 8th Imported Yarn Forum)” in Changzhou, Jiangsu on Jun 13-14, 2019, and we sincerely invite you to discuss the industry integration and explore the connection of spot and futures market with industry elite.

Meeting Matters

Schedule

Registration: A.M. June 13, 2019Forum: P.M. June 13- June 14, 2019

Exhibition: P.M. June 13-June 14, 2019

Venue

Sheraton Changzhou Xinbei Hotel (No. 88-1, Tongjiang Road (M.), Xinbei District, Changzhou, China)Conference Fee

*USD 500/personAccommodation Fee

Twin-bed Room: RMB 500/person/dayKing-size Room: RMB 500/person/day(The price is available during the conference, and the validity date is from Jun 12 to Jun 15)

Contacts

Contact: Nicole WangTel: +86-571-83786741/86- 15158039489

Fax: +86-571-83786600

E-mail: market@ccfgroup.com, wxq@ccfgroup.com

Cancellation and refund

A full refund will be available if written-form cancellation to us is done before June 3, 2019Forum Agenda

(Note: topics are still updating and subject to changes)| Afternoon, Jun 13 |

|---|

|

14:00-14:40 Analysis on bulk commodity market operation and thought on trading of cotton industry chain futures ——Dr. Qiu Qinwei, Senior economist, Shenyin & Wanguo Futures |

|

14:40-15:10 Exploration to cotton and cotton yarn purchasing strategy and participation in futures ——Lu Xiuli, Raw material manager,Sunvim Group |

|

15:10-15:30 Tea break |

|

15:30-16:10 Adjustment of cotton yarn futures rules ——Zu Li, Agricultural product department,Zhengzhou Commodity Exchange |

|

16:10-16:40 Main points of production technology of benchmark cotton yarn for delivery ——Wang Kewei, Investment department,Weishi Textile |

|

16:40-17:10 Interpretation on quality indicator requirements for cotton yarn futures warehouse receipt and test method ——Sun Fang, Senior engineer,Zhejiang Textile Testing & Research Institute |

| Evening, Jun 13 |

|

Specified invitation: cotton, yarn and fabric session ——Customers from the whole industry chain |

| Morning, Jun 14 |

|

8:30-9:30 China Macro Economy during Trade War and Deleveraging ——Dr. Xiao Lisheng,Institute of World Economics and Politics (IWEP),Chinese Academy of Social Sciences (CASS) |

|

9:30-10:10 China cotton textile industry operation analysis in 2019 ——Ye Jianchun, Vice president,China Cotton Textile Association (CCTA) |

|

10:10-10:30 Tea break |

|

10:30-11:20 Global Cotton Supply and Demand Pattern Outlook and Hotspot Analysis ——Mr. James W.Johnson,USDA |

|

11:20-12:00 China cotton supply and demand structure and price trend analysis ——Xia Shihui,CCFGroup |

| Afternoon, Jun 14 |

|

14:00-14:40 Profit comparison of new-type spinning investment and research on industry development ——Jiang Li, General manager of spun yarn department,Rifa Textile Machinery |

|

14:40-15:10 Knitting market status and cotton yarn purchasing strategy ——Wei Siying, General manager,Fountain Set (Holdings) Highscene Limited |

|

15:10-15:30 Tea break |

|

15:30-16:20 New market pattern and forecast of cotton and cotton yarn industry chain ——Zheng Shengwei,CCFGroup |

|

16:20-17:40 Round-table session: Interpretation and forecast of cotton-cotton yarn-grey fabric-printing and dyeing-apparel industry chain supply and demand ——Huafu Fashion (Sun Xiaoting), Huafang Group (Xiao Jingyao), Tongzhou Cotton (Wei Gangmin), Black Peony (Zhu Rongping), Fountain Set Highscene (Wei Siying), Sunvim Home Textile (Lu Xiuli) |

Join In

Sponsorship

Deadline: May 31, 2019

| Items | Form | Fee (USD) | Remark | |

|---|---|---|---|---|

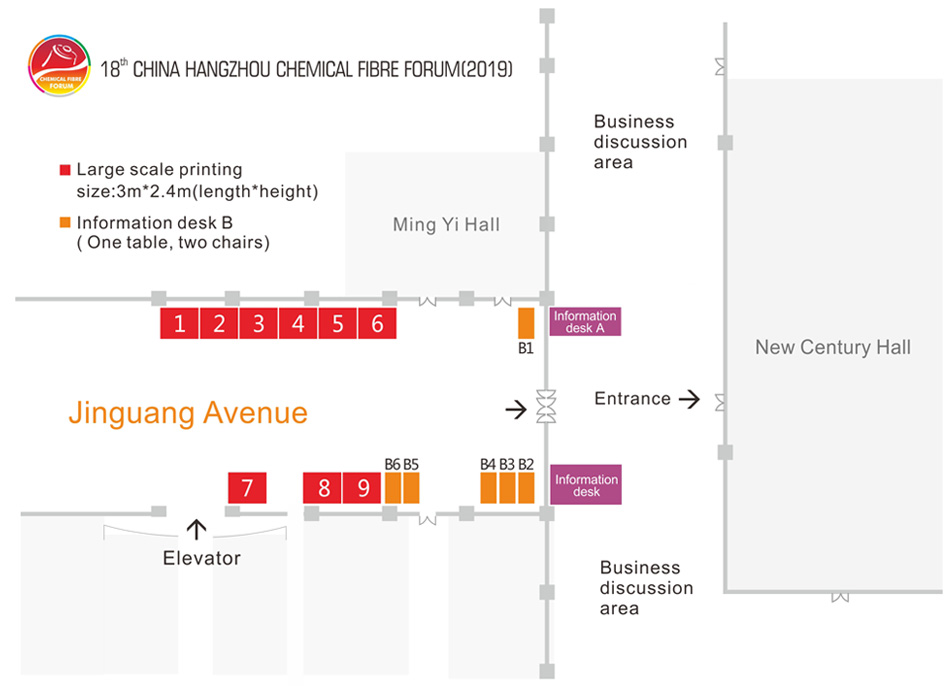

| Large-Scale printing (see attached chart) |

Reception desk backdrop | 1800 | Size: 4m width × 2.8m height, exclusive | |

| Conference desk backdrop | 1500 | Size: 3m width × 2.6m height, exclusive | ||

| Negotiation area backdrop C01 | 1500 | Size: 4m width × 2.8m height, exclusive | ||

| Advertising board C02-C10 | 1200 | Size: 3m width × 2.6m height | ||

| Booth (see attached chart) |

Booth in Zone A and B | ★ Advertising board (3m width× 2.6m height) ★ One table, three chairs ★ 1 complimentary registration for foreign participant. ★ 1 king-size rooms for free, two nights; ★ half colored page |

2000 | Size: 3m length × 2m depth Optional location: A09-A18, B01, B02, B09-B15 |

| Booth (with negotiation area) |

★ Advertising board (3m width× 2.6m height) ★ One table, three chairs ★ Negotiation area ★ 1 complimentary registration for foreign participant. ★ 1 king-size rooms for free, two nights; ★ half colored page |

2300 | Size: 3m length × 2m depth Optional location: B03-B08 |

|

| Conference proceedings (A4 color printed) | Cover | 1500 | Self-designed size specifications: size: 21.6cm × 29.1cm resolution: 300dpi | |

| Inside front cover | 1050 | |||

| Inside back cover, back cover | 750 | |||

| Prime page 1 | 1050 | |||

| Other inner pages | 450 | |||

| Page footer (within 25 Chinese characters like company name, telephone number and advertisement) | 450 | |||

| Sponsors video display | ★ Before the conference ★ within 5 minutes ★ The video is provided by the sponsor. |

1200 | Three companies | |

| Tea break sponsor | ★ One colored page in the conference proceedings ★ 2 complimentary registrations for foreign participants ★ 5-minute video display before the conference ★ Two advertising boards in tea break area |

2650 | Exclusive | |

| Organizer Negotiation area sponsor |

★ Sponsor's supply and demand wall in negotiation area ★ Two advertising boards in negotiation area ★ One colored page in the conference proceedings |

1500 | Exclusive | |

| Drinking water sponsor | ★ One tag on each bottle of drinking water | 2200 | Exclusive 35mm*35mm |

|

| Roll-up banner | ★ Roll-up banner (0.8m x2m) ★ Inside conference hall or lobby area |

600 | Limited | |

| Attendee directory (page footer) | ★ Company name, telephone number or advertisement (within 25 Chinese characters) |

750 | Exclusive | |

| Conference badge and lanyard sponsorship | ★ Company name, logo or advertisement (within 25 Chinese characters) ★ The lanyard is provided by the sponsor. |

1500 | Exclusive | |

| Material bag | ★ Company branded material in conference bag supplied by the sponsor. | 750 | Exclusive | |

| Conference gift sponsor | ★ Designed and provided by the sponsor ★ Distributed by the organizer |

450 | Two companies | |

| Promotional materials | ★Promotional materials in the conference bag ★ One brochure provided by the sponsor |

450 | Five companies | |

| WeChat advertising | ★Hyperlinks banner ads (size: 600*400) (official account:

华瑞资讯TTEB, CCFGroup) ★2 posts on WeChat during conference promotion (not headline), China Cotton Textile Forum related content only |

600 | Two companies | |

Contacts

| Zhejiang Huarui Information Consulting Co., Ltd. (www.ccfgroup.com) | |

| ·Address: | 26-27/F, Building 1, Huarui Center, No. 66 Jianshe 1st Road Xiaoshan District,Hangzhou, Zhejiang, China |

| ·Contact: |

Nicole Wang Phone: +86-571-83786741/86- 15158039489 |

| ·Fax: | +86-571-83786600 |

| ·E-mail: | market@ccfgroup.com, wxq@ccfgroup.com |